What it takes to raise capital in 2023

The fundraising environment remains tricky to navigate for startups. Frameworks, like Point 9’s renowned SaaS funding napkins, offer a good a good temperature check on the early stage funding market.

I always study Point 9’s annual SaaS funding napkins as they are a good reference point re how to think about funding rounds for SaaS startups.

Caveat (of course): Remember that in VC land, things are much more intricate than a mere checklist - there are a lot more things that go into successfully raising from institutional investors vs what can be captured on a napkin.

That said, I’m a fan of using frameworks such as the funding napkin as they provide a good temperature check re what is going on in the SaaS financing market.

Here’s what it took to raise capital in SaaS in 2022

For context, the 2022 funding napkin came out in early Q3 2022 when the market had significantly cooled off from its 2021 highs. Or as Point 9 put it back then:

Given the drastic change in the funding environment that started in February, creating the 2022 version of the napkin was particularly interesting. It was also tricky because the market has changed so much in the last few months and may continue to do so. In times like this, measuring the market’s temperature by looking at historical data comes with the risk of being embarrassingly wrong just a few months later. In fact, that’s why we hesitated to get a printed version of the napkin out throughout 2020/2021. Valuations of 100x ARR weren’t unusual, especially in the second half of 2021, but I guess we didn’t want to eternalize them by printing them on a napkin.

See here for their full SaaS funding napkin release post from 2022

Now onto 2023 …

Here’s what it takes to raise capital in SaaS in 2023

Looking at 2023 funding data / numbers:

Significantly fewer rounds get done vs the peak years - the total volume of financing rounds is down 50-75% from 2021 (depending on the source / stage / market)

(Somewhat surprisingly), valuations especially at seed are not far off from the 2021 peak at $15M vs $13.5M today (according to Carta). This is very much in line with what we’re seeing and hearing in the market.

A good way to summarize what is going on: In 2023’s early stage SaaS funding market, significantly fewer startups are able to raise but the ones that do raise do so with high valuations.

Here are three often cited reasons as to why that is:

Overall, less capital gets deployed and many firms have significantly slowed down their deployment pace. Plus many newer and / or “tourist” VC firms have left the market. Thus a lot fewer deals get done.

That said, there’s still a lot of money being deployed at seed - both from seed funds as well as, as Sam Lessin recently put it:

“The awkward ‘crowd’ into seed investing by multi-stage firms (and even just late-stage firms) as they look for where the ‘can’ deploy capital given the factory ‘shutdown’ & based on the incentives of all the people they hired to ‘write checks’ to build a track record & get ahead.”

While everyone is more picky, this leads to a lot of competition for what are considered “the best deals”, driving up prices. The same applies to a lesser degree at Series A.The bar to raise is higher - companies tend to raise later vs the 2020 - 2021 period / the milestones needed to get a Seed and Series A done have moved significantly since the market cooled. While it was possible to raise a Series A off of $200K ARR (anecdotally), this number is now closer to $2-3M. This to a degree justifies the higher valuations. That said, this has profound implications on how founders need to look at burn, runway, and their fundraising strategy. Stating the obvious - capital efficiency really matters now and investors once again really care about it. Balancing growth with efficiency is essential.

A founder in our portfolio put it well when we discussed this topic internally: “Feels like for the first time in maybe 15 years, you can attempt to be early stage profitable, and use that leverage to raise against better revenue comps as opposed to just raw growth and fabricated markups. Harder since most companies founded in recent years have no plans for profitability in sort term scenarios, but if you have a path towards it you will have supportive investors now, instead of "burn baby burn" and dice roll on parabolic growth.”

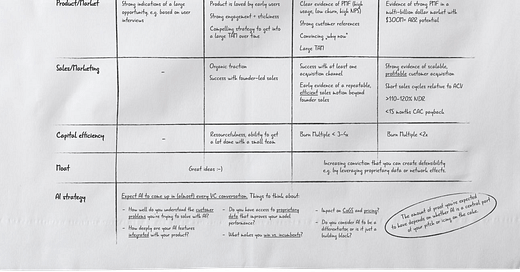

Here’s the 2023 SaaS funding napkin.

Notice especially the difference in revenue numbers vs 2022 (while expected YoY growth rates remain the same for the most part).

Last but not least, it’s also worth calling out what the folks at Point 9 remark regarding investors wanting to see an Ai strategy:

Half of the respondents told us that a convincing AI strategy has become more important. […] The right AI strategy, of course, depends on the company, product, and market, and getting into this would go way beyond the scope of this post, so I’ll just list a few questions that I think you should think about:

How well do you understand your customers, the problems you’re trying to solve, and how to solve them better with AI?

Are you just “sprinkling AI onto a deck or product”?

How deeply are your AI features integrated with your product?

What makes you win vs. OpenAI and other foundational models, as well as incumbents in your space?

Do you have access to proprietary customer data that others don’t have and that improves your model performance? Does that give you a sustainable competitive advantage?

Is there a feedback loop that helps you improve performance?

Have you thought about the impact of your AI features/roadmap on CoGS and pricing?

Do you consider AI to be a core part of your differentiation and moat, or just as a building block?

See here for their full SaaS funding napkin release post from 2023

If you’re seeing something different in the market, let me know - would love to discuss it.

Pascal

I would not be surprised that the "Seed" column moves to the "PreSeed" column for 2024. If you look at the data from Rightside Capital; more than 54% of VC expect preSeed SaaS companies to be post-revenue in the SaaS space with more than 25%+ requiring $150K ARR minimum.

It seems the market in pre-seed is moving to requiring startups to have a lot more traction (as described in the Seed column) than in years past.